Age 69 Director since: 2015 INDEPENDENT Committees: • Audit (Chair) | | Skills and Qualifications Highlights: • Strategic Leadership and Financial Literacy • Experience in International Operations • Governmental Experience and Regulatory Expertise • Merger, Acquisition and/or Joint Venture Expertise

Other Public Company Directorships: • AptarGroup, Inc. • Royal Caribbean Cruises Ltd. • Comcast Corporation Other Public Company Directorships Held during the Past 5 Years: • AptarGroup, Inc. • Royal Caribbean Cruises Ltd. • Comcast Corporation

| Maritza G. Montiel

Ms. Montiel’s qualifications include (i) strategic leadership at a large, complex, organization, (ii) governmental experience, (iii) a high level of financial literacy, and (iv) experience in developing effective governance and shared responsibility models. Ms. Montiel served for more than 40 years at Deloitte LLP before retiring in June 2014. Her most recent appointmentposition was as Deputy Chief Executive Officer and Vice Chairman of the firm’s U.S. business. As Deputy CEO, Ms. Montiel led a variety of strategic initiatives including the transformation of the $1.4 billion Federal Government Services Practice. She was also a member of the Deloitte Touche Tohmatsu Limited Global Board of Directors. Prior to her most recent role with Deloitte, Ms. Montiel served as Regional Managing Partner for the Southwest Region in which she led the organization through significant growth, from $600 million in revenue and a 1,800 member team to over $2 billion in revenue and a team of 9,000.growth. Ms. Montiel was also the Managing Partner responsible for Leadership Development & Succession, as well as Deloitte University where she developed and implemented a $350 million strategic initiative aimed at transforming Deloitte’s professional development curriculum and training the next generation of leaders. The McCormick Board of Directors has determined that Ms. Montiel meets the standards of an “audit committee financial expert” under the rules of the SEC. Ms. Montiel currently serves on the boards of AptarGroup, Inc., Royal Caribbean Cruises Ltd. and Comcast Corporation. | | | | | |

MARGARET M.V. PRESTON | | |

Age 63 Director since: 2003 INDEPENDENT Committees: Margaret M.V. Preston• Compensation and Human Capital

| | Skills and Qualifications Highlights: • Strategic Leadership and Financial Literacy • Experience in International Operations • Merger, Acquisition and/or Joint Venture Expertise • Experience Aligning Compensation with Performance

Other Public Company Directorships: • Otis Worldwide Corporation Other Public Company Directorships Held during the Past 5 Years: • Otis Worldwide Corporation

Ms. Preston’s qualifications include (i) senior executive experience at a publicly traded multinational company, (ii) strategic leadership at a large, complex, organization, (iii) a high level of financial literacy, and (iv) experience in mergers and acquisitions. Ms. Preston’s past service as the Global Chief Financial Officer of Deutsche Bank, Private Wealth Management and as a Managing Director and Regional Executive of US Trust, Bank of America Private Wealth Management, and her current service as a Managing Director of TD Bank Private Wealth Management has afforded to Ms. Prestonher the opportunity to provide financial oversight and strategic leadership and direction to those organizations.organizations, until her retirement in 2019. As Treasurer of Alex. Brown Incorporated, Ms. Preston provided direction in the development of a collateral management system for margin loan management, and her role at US Trust included responsibility for the management of compliance and risk at the Private Wealth Management group for over $20 billion of assets under management at that organization. Ms. Preston has a well-developed experience in mergers and acquisitions, and the integration of acquired businesses, in consequence of her work, first at Alex. Brown as a Merger & Acquisition Manager, and subsequent work on the integration of the Bankers Trust Company and Alex. Brown businesses into Deutsche Bank, and the integration of Merrill Lynch operations into the Bank of America Private Wealth Management platform. Ms. Preston currently serves on the board of Otis Worldwide Corporation. | | | | | |

McCORMICK & COMPANY, INCORPORATED- Proxy Statement 811 | GARY M. RODKIN | | |

Age 68 Director since: 2017 INDEPENDENT Committees: • Nominating/ Corporate Governance | | Skills and Qualifications Highlights: • Strategic Leadership and Financial Literacy • Consumer Marketing Experience • Merger, Acquisition and/or Joint Venture Expertise • Executive Experience at Publicly Traded Company

Other Public Company Directorships: • Simon Property Group, Inc. Other Public Company Directorships Held during the Past 5 Years: • Simon Property Group, Inc. • Avon Products, Inc.

| Gary M. Rodkin

Mr. Rodkin’s qualifications include (i) senior executive experience at a publicly traded multinational company, (ii) consumer marketing experience, (iii) a detailed knowledge of the food industry, (iv) strategic leadership of a large, complex, organization, and (v) experience in mergers and acquisitions. Mr. Rodkin is a seasoned and successful former Chief Executive Officer who has led major consumer products goods businesses and companies. Most recently, Mr. Rodkin served as the President and Chief Executive Officer of ConAgra Foods, Inc. from 2005 to 2015, where he transformed ConAgra from a holding company into one unified business with a balanced portfolio of consumer, commercial and private-brand businesses and strong operating capabilities. Prior to joining ConAgra, Mr. Rodkin served as Chairman and Chief Executive Officer of the Beverages and Food division at PepsiCo, Inc., where he was accountable for two lines of business, PepsiCo Beverages North America and Quaker Foods North America. Previously, Mr. Rodkin spent sixteen years with General Mills, Inc. in a variety of management roles. Mr. Rodkin currently serves on the board of Simon Property Group, Inc., an equity real estate investment trust, as well as on the non-profit boards of Feeding America, a hunger-relief charity, as Chairman, and as the Vice Chairman of the Board of Overseers for Rutgers University. Mr. Rodkin is a Fellow of Executive Education at Harvard Business School, and an Executive in Residence at Rutgers University. | | | | | |

JACQUES TAPIERO | | |

Age 62 Director since: 2012 INDEPENDENT Committees: Jacques Tapiero• Compensation and Human Capital

| | Skills and Qualifications Highlights: • Strategic Leadership and Financial Literacy • Experience in International Operations • Executive Experience at Publicly Traded Company • Experience Aligning Compensation with Performance

Other Public Company Directorships: • None Other Public Company Directorships Held during the Past 5 Years: • None

Mr. Tapiero’s qualifications include (i) senior executive experience at a publicly traded multinational company, (ii) general management experience in international operations, and (iii) strategic leadership at a large, complex, organization. Mr. Tapiero served as Senior Vice President and President, Emerging Markets of Eli Lilly and Company, the Indianapolis, Indiana-based global pharmaceutical company, from 2009 until his retirement from that company on January 31, 2014, after 31 years of service. He was also a member of the Executive Committee of Eli Lilly. The Emerging Markets Business Unit focused on many of the organization’s fastest growing markets, such as China, Russia, Brazil, Mexico, South Korea and Turkey, and Mr. Tapiero was responsible for Lilly’s business in more than 70 countries. Prior to becoming President, Emerging Markets, Mr. Tapiero held the position of President of the Intercontinental Region for Lilly, with operations in Asia, Australia, Africa, the Middle East, Canada, Latin America and Russia (2004 to 2009). He also served as President and General Manager of Lilly France (2000 to 2004); President and General Manager of Eli Lilly do Brasil Ltd (1995 to 1999); and Managing Director of Lilly Sweden (1993 to 1995). Mr. Tapiero joined Lilly in 1983 as a financial analyst, and held several financial management, sales and marketing management positions in the United States, Switzerland and France. Mr. Tapiero is a senior advisor to McKinsey and Company Pharmaceuticals and Medical Products practice, and a director of Esteve – Spain (a private chemical and pharmaceuticals group). | | | | | |

McCORMICK & COMPANY, INCORPORATED- Proxy Statement12 | W. ANTHONY VERNON | | |

Age 65 Director since: 2017 INDEPENDENT Committees:  • Compensation and Human Capital (Chair)

| | Skills and Qualifications Highlights: W. Anthony Vernon• Strategic Leadership and Financial Literacy

• Knowledge of the Food Industry • Executive Experience at Publicly Traded Company • Merger, Acquisition and/or Joint Venture Expertise

Other Public Company Directorships: • Intersect ENT, Inc. • Novocure Limited Other Public Company Directorships Held during the Past 5 Years: • Intersect ENT, Inc. • Novocure Limited • Axovant Sciences, Inc. • WhiteWave Foods Company • Medivation, Inc.

Mr. Vernon’s qualifications include (i) senior executive experience at a publicly traded multinational company, (ii) consumer marketing experience, (iii) a detailed knowledge of the food industry, (iv) strategic leadership of a large, complex, organization, and (v) experience in mergers and acquisitions. Mr. Vernon is a seasoned and successful former Chief Executive Officer who has led major consumer products goods businesses and companies. Most recently, Mr. Vernon served as the Chief Executive Officer of the Kraft Foods Group from 2012 to 2014 and remained with the company as a Senior Advisor and Executive Director until April 2015. He was the first CEO of the newly formed company when Kraft Foods split its snack and grocery divisions into two independent public companies. Mr. Vernon also served as Executive Vice President of Kraft Foods and President of North America from 2009 to 2012. Prior to joining Kraft, Mr. Vernon served as Healthcare Industry Partner of Ripplewood Holdings LL, a private equity firm. He also held several leadership roles at Johnson & Johnson where he spent 23 years of his career managing some of the company’s largest consumer brands including Tylenol, Motrin, Pepcid AC, Imodium and Splenda. Mr. Vernon also served as President of Centocor, a Johnson & Johnson biotechnology company. Mr. Vernon currently serves on the boards Intersect ENT, Inc. and Novocure Limited. | | | | | |

McCORMICK & COMPANY, INCORPORATED- Proxy Statement 913 Board Leadership The Company’s Board of Directors is led by our Chairman, Lawrence E. Kurzius, who is also our President and Chief Executive Officer.CEO. McCormick has historically combined the roles of chairman and chief executive officer, though we have separated the roles based on the needs of the Company and its stockholders at certain times. The Board of Directors believes that the Company currently is and has been well served by a combined structure, as it provides a bridge between management and the Board, thus helping to ensure that both act with commonality of purpose with efficient communication between them. The Board believes that the CEO is in the best ableposition to bring key business issues and stockholder interests to the Board’s attention, given his in-depth understanding of the Company. As well, thisCompany and its operations. This structure also helps ensure accountability for the actions and strategic direction of the Company, and ensures that the Company presents its message and strategy to stockholders, employees and customers with a unified voice. The Board also has the position of Lead Director who provides additional independent oversight of senior management and board matters in our current structure where the Chairman is not an independent director. The selection of a lead director is meant to facilitate, and not to inhibit, communication among the directors or between any of them and the Chairman and CEO. Accordingly, directors are encouraged to continue to communicate among themselves and directly with the Chairman and CEO. The independent directors, meeting in executive session in November 2009, selected Michael D. Mangan to serve as the Lead Director, and he continues to act in that role. The duties of the Lead Director are to (i) preside at executive sessions of the Board, and brief the Chairman and CEO, as needed, following such sessions; (ii) preside at meetings of the Board where the Chairman is not present; (iii) call meetings of the independent directors; (iv) provide input on Board agendas and meeting schedules; (v) provide feedback to the Chairman and CEO on the quality of information received from management; and (vi) participate with the Chairman and CEO, and the Nominating/Corporate Governance Committee in interviewing Board candidates. The Lead Director position generally has had aan initial two-year term.term, which may be extended as determined by the Board from time to time. In November 2017,April 2020, the Board determined to extend Mr. Mangan’s current term through March 2018 to align the selection ofrole as the Lead Director with the annual shareholders meeting and other Board and Committee appointment decisions.for another two-year term. The Board believes that the combined Chairman and CEO structure, coupled with an independent Lead Director, the use of regular executive sessions of the non-management Directors, and the substantial majority of independent directors comprising the Board, allows the Board to maintain effective oversight of the Company. Board Committees The Board of Directors has appointed the following Board Committees: Audit Committee TheThe Charter of the Audit Committee provides that the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibility relating to:

| ●• | the integrity of McCormick’s financial statements, the financial reporting process, and the systems of internal accounting and financial controls; |

| ●• | the performance of McCormick’s internal audit function; |

| ●• | the appointment, engagement and performance of McCormick’s independent registered public accounting firm and the evaluation of the independent registered public accounting firm’s qualifications and independence; |

| ●• | compliance with McCormick’s business ethics and confidential information policies and legal and regulatory requirements, including McCormick’s disclosure controls and procedures; and |

| ●• | the evaluation of enterprise risk management process issues.process. |

In so doing, it is the responsibility of the Audit Committee to maintain free and open communication between the Committee, the independent registered public accounting firm, the internal auditors, and management of McCormick and to resolve any disagreements between management and the independent registered public accounting firm regarding financial reporting. The Committee also performs other duties and responsibilities set forth in a written Charter approved by the Board of Directors. The Charter of the Audit Committee is available on McCormick’s Investor Relations website at ir.mccormick.com under “Corporate Governance,” then “Board Committees.“Audit Committee Charter.” The Nominating/Corporate Governance Committee and the Board of Directors have determined that all members of the Audit Committee satisfy the independence requirements of the NYSE’s Listing Standards, the rules of the SEC, and McCormick’s Corporate Governance Guidelines. NoOne member of the Audit Committee, Maritza Montiel, serves on the audit committees of more than three public companies.companies; however, the Board of Directors has determined that Ms. Montiel’s simultaneous service does not impair her ability to effectively serve on McCormick’s Audit Committee. The Board of Directors has also determined that at least one member qualifiestwo of the three members of the Audit Committee qualify as an “audit committee financial expert” under SEC rules. McCORMICK & COMPANY, INCORPORATED - Proxy Statement 1014 Compensation and Human Capital Committee The Compensation and Human Capital Committee has the following principal duties and responsibilities: | • | ● | reviewreviewing McCormick’s executive compensation programs to ensure that they (i) effectively motivate the CEO and other executive officers to achieve our financial goals and strategic objectives; (ii) properly align the interests of these employees with the long-term interests of our stockholders; and (iii) are sufficiently competitive to attract and retain the executive resources necessary for the successful management of our businesses; |

| • | ●overseeing McCormick’s strategies and policies related to key human resources policies and practices including with respect to matters such as diversity and inclusion, workplace environment and culture, and talent development and retention; | | • | reviewreviewing trends in executive compensation, oversee the development of new compensation plans (including performance-based, equity-based, and other incentive programs, as well as salary, bonus and deferred compensation arrangements) and, when appropriate, make recommendations to the Board regarding revisions to existing plans and/or approve revisions to such plans; |

| ●• | annually reviewreviewing and approveapproving corporate goals and objectives relevant to McCormick’s CEO and other executive officers, evaluate the performance of such individuals against those goals and objectives, and approve the compensation for such individuals; |

| ●• | annually evaluateevaluating the relationship between the Company’s overall compensation policies and practices and risk; |

| ●• | annually evaluateevaluating the compensation of the members of the Board; and |

| • | ● | reviewreviewing McCormick’s management succession plan for the CEO and other executive officers. |

These duties and responsibilities are set forth in a written Charter approved by the Board which is available on McCormick’s Investor Relations website at ir.mccormick.com under “Corporate Governance,” then “Board Committees.“Compensation and Human Capital Committee Charter.” Pursuant to its Charter, the Committee has the authority to delegate certain of its responsibilities to a subcommittee; however, to date no such delegation has been made. The Committee has the authority to administer McCormick’s equity plans for the CEO and other executive officers. The Committee is responsible for all determinations with respect to participation, the form, amount and timing of any awards to be granted to any such participants, and the payment of any such awards. All members of the Committee qualify as independent directors under McCormick’s Corporate Governance Guidelines and the NYSE’s Listing Standards, and as “non-employee directors” and “outside directors” for the purposes set forth in the Committee’s Charter. Nominating/Corporate Governance Committee The Nominating/Corporate Governance Committee assists the Board by: | ●• | developing and implementing corporate governance guidelines; |

| ●• | establishing criteria for the selection of nominees for election to the Board, and identifying and recommending qualified individuals to serve as members of the Board; |

| ●• | evaluating and making recommendations regarding the size and composition of the Board and its Committees (including making determinations concerning the composition of the Board and its Committees under the applicable requirements of the SEC and the NYSE); and |

| ●• | monitoring a process to assess the effectiveness of the Board and its Committees.Committees; and | | • | overseeing McCormick’s corporate responsibility programs relating to Environment, Social, and Governance (ESG) matters, except to the extent reserved for the full Board or another committee of the Board. |

The Committee is also responsible for performing other duties and responsibilities set forth in a written Charter approved by the Board of Directors. The Charter of the Committee and McCormick’s Corporate Governance Guidelines are available on McCormick’s Investor Relations website at ir.mccormick.com under “Corporate Governance,” then “Board Committees.“Nominating/Corporate Governance Committee Charter.” All members of the Committee qualify as independent directors under McCormick’s Corporate Governance Guidelines and the NYSE Listing Standards. Committee Membership and Meetings The table below shows the current members of each of the Committees and the number of meetings held by each Committee in fiscal 2017.2020. | Name | Audit | Compensation | Nominating/

Corporate Governance | | Audit | | Compensation and

Human Capital | | Nominating/

Corporate Governance | | Anne L. Bramman | | | | • | | | | | | | | | | | Michael A. Conway | ● | | | • | | | J. Michael Fitzpatrick | ● | | | | Freeman A. Hrabowski, III | | Chair | | Chair | | | Patricia Little | Chair | | | • | | | Michael D. Mangan(1) | | Chair | ● | | • | | • | | | Maritza G. Montiel | | ● | | | Chair | | | Margaret M.V. Preston | | ● | | • | | | Gary M. Rodkin | | ● | | • | | | Jacques Tapiero | | ● | | | • | | | W. Anthony Vernon | | ● | | | Chair | | | Number of Committee Meetings Held in Fiscal 2017 | 9 | 7 | 4 | | | Number of Committee Meetings Held in Fiscal 2020 | | | 8 | | 10 | | 4 | |

McCORMICK & COMPANY, INCORPORATED - Proxy Statement 1115 Director Attendance at Meetings During fiscal 2017,2020, there were six regular meetings, and fourtwo special meetings of the Board. Each incumbent director attended at least 75% of the total number of meetings of the Board and each of the Board Committees on which he or she served. Messrs. Rodkin and Vernon, who were elected to the Board effective January 24, 2017 and May 23, 2017, respectively, attended at least 75% of the Board and Nominating/Corporate Governance Committee meetings following their election to the Board.served during fiscal 2020. Each year, the Board of Directors meets on the same day as the Annual Meeting of Stockholders. Although there is no policy requiring Board members to attend the Annual Meeting of Stockholders, all Board members are encouraged to attend and typically do so. All Board members attended last year’s Annual Meeting of Stockholders. Risk Oversight A summary of the allocation of general risk oversight functions among management, the Board and its Committees is as follows: | |  |  | | | | | BOARD OF DIRECTORS | | | | |  | | | | | Continuous oversight of overall risks, with emphasis on strategic risks, as well as reputation and operational risks, along with oversight of the Company’s risk management and risk mitigation processes at both the full Board and Board Committee levels | | | | | | | |   |  |   | |  | AUDIT

COMMITTEE | | COMPENSATION AND HUMAN

CAPITAL COMMITTEE | | NOMINATING/CORPORATE

GOVERNANCE COMMITTEE |  | |  | |  | | Oversees the risk management process, with an emphasis on risk management processes related to financial reporting, internal controls and financial risks | | Compensation policies, practices and incentive-related risks, organizational talent and culture, and management succession risks; and risks related to key human resources policies and practices | | Governance structure, Board composition and succession risks; and risks relating to Environment, Social, and Governance (ESG) matters | | | | | | | |  |  | | | | | MANAGEMENT | | | | |  | | | | | Responsible for the day-to-day management of the risks facing the Company | | |

McCORMICK & COMPANY, INCORPORATED - Proxy Statement 1216 Board of Directors The full Board assesses the Company’s strategic direction and operational risks throughout the year. In addition, management annually provides the Board with an enterprise risk management (“ERM”)a review of the strategicenterprise risk issuesassessment which highlights the enterprise risks and major trends that may impact business functions and the Company’s overall risk profile, with recommendations for responsive action on ERM issues as needed.enterprise risks. These plans and related risks are monitored throughout the year as part of the regular financial and performance reports given to the Board and Board Committees by management. McCormick’s Chief Risk Officer works with Company personnel representing multiple functional and regional areas within our Company to provide broad oversight of the process and our enterprise risks. In addition to helping assess enterprise risk issues and major trends that may impact business functions, operating units, and the Company’s overall risk profile, the enterprise risk management process also entails (i) reviewing the Company’s enterprise risk management framework, including risk identification and assessment, and recommends responsive actions on enterprise risk issues, as needed; and (ii) discussing the quality of business processes and practices at the Company, and reviewing how the Company will achieve its objectives within the enterprise risk framework. In addition to the formal compliance program, the Board encourages management to promote a corporate culture that incorporates risk management into the Company’s corporate strategy and day-to-day business operations. Audit Committee The Board has designated the Audit Committee to take the lead in overseeing the risk management process. The Audit Committee makes regular reports to the Board regarding briefings by management and advisors as well as the Committee’s own analysis and conclusions regarding the adequacy of the Company’s risk management process. Compensation and Human Capital Committee The Compensation and Human Capital Committee considers the relationship between the Company’s compensation policies and practices for all employees and risk, including whether such policies and practices encourage imprudent risk taking, and/or would be reasonably likely to have a material adverse effect on the Company. In performing its responsibilities, the Committee receives regular reports on compensation matters and trends from the Committee’s independent compensation consultant. In 2017,2020, the Compensation and Human Capital Committee evaluated the current risk profile of our executive and broad-based compensation programs, as discussed below in “Performance-Based Compensation and Risk.” Additionally, the Compensation and Human Capital Committee reviewed the Company’s incentive plans (executive and broad-based) to determine if any practices might encourage excessive risk taking on the part of senior executives. The Committee noted features of the Company’s incentive plans (executive and broad-based) that mitigate risk, including the use of multiple measures in our annual and long-term incentive plans, Compensation and Human Capital Committee discretion in payment of incentives in the executive plans, use of various types of long-term incentives, payment caps, significant stock ownership guidelines, and our clawback policy. In light of these analyses, the Compensation and Human Capital Committee believes that the Company’s compensation programs (executive and broad-based) provide multiple and effective safeguards to protect against undue risk. In 2020, the Committee added the responsibility of oversight of human capital management practices, including review of related human capital disclosure in the Company’s Form 10-K for the 2020 fiscal year. Nominating/Corporate Governance Committee The Nominating/Corporate Governance Committee oversees risks related to corporate governance and Board composition. The Committee establishes criteria (for approval of the Board) for the selection of nominees for election to the Board, and reviews, evaluates and makes recommendations to the Board about its Committee structure and operations to ensure a commitment to effective governance. McCORMICK & COMPANY, INCORPORATED - Proxy Statement 1317 Other Directorships

Certain individuals nominated for election to the Board of Directors hold, or have held in the past five years, directorships in other public companies:

| Name | Current | 2017 | 2016 | 2015 | 2014 | 2013 | | Michael A. Conway | — | — | — | — | — | — | | J. Michael Fitzpatrick | ●Ingevity Corp. | ●Ingevity Corp. | ●Ingevity Corp. | — | — | — | | Freeman A. Hrabowski, III | ● T. Rowe Price Group, Inc. | ● T. Rowe Price Group, Inc. | ● T. Rowe Price Group, Inc. | ● T. Rowe Price Group, Inc. | ● T. Rowe Price Group, Inc. | ● T. Rowe Price Group, Inc. | | Lawrence E. Kurzius | — | — | — | — | — | — | | Patricia Little | — | — | — | — | — | — | | Michael D. Mangan | ●Nutrisystem, Inc. | ●Nutrisystem, Inc. | ●Nutrisystem, Inc. | ●Nutrisystem, Inc. | — | — | | Maritza G. Montiel | ●AptarGroup, Inc. ● Royal Caribbean Cruises Ltd. | ●AptarGroup, Inc. ●Royal Caribbean Cruises Ltd. | ●AptarGroup, Inc. ●Royal Caribbean Cruises Ltd. | ●AptarGroup, Inc. ●Royal Caribbean Cruises Ltd. | — | — | | Margaret M.V. Preston | — | — | — | — | — | — | | Gary M. Rodkin | ●Simon Property Group, Inc. | ●Simon Property Group, Inc. | ●Simon Property Group, Inc. ●Avon Products, Inc. | ●Simon Property Group, Inc. ●Avon Products, Inc. ●ConAgra Foods, Inc. | ●Avon Products, Inc. ●ConAgra Foods, Inc. | ●Avon Products, Inc. ●ConAgra Foods, Inc. | | Jacques Tapiero | — | — | — | — | — | — | | W. Anthony Vernon | ●Intersect ENT, Inc. ●Novocure Limited ●Axovant Sciences, Inc. | ●Intersect ENT, Inc. ●Novocure Limited ●Axovant Sciences, Inc. ●WhiteWave Foods Company | ●Intersect ENT, Inc. ●Novocure Limited ●Medivation, Inc. ●WhiteWave Foods Company | ●Intersect ENT, Inc. ●Novocure Limited ●Medivation, Inc. ●Kraft Foods Group, Inc. | ●Kraft Foods Group, Inc. ●Novocure Limited ●Medivation, Inc. | ●Kraft Foods Group, Inc. ●Novocure Limited ●Medivation, Inc. |

Stock Ownership and Service on Other Boards ItEach non-management director is expected that each non-management director willto acquire, within five years after his or her election to the Board, a number of shares having a value at least equal to fourfive times the annual retainer paid to such member for service on the Board. The annual retainer was $90,000 during 2017.2020. The annual retainer is paid in quarterly installments with the first quarterly installment upon election to the Board being paid in Common Stock to assist in meeting the Company’s stock ownership expectations (subsequent quarterly payments are paid in cash). Such ownership must thereafter be maintained while serving on the Board.

No director of the Company may serve on the boards of more than four other publicly traded companies while also serving on McCormick’s Board; however, if such director also serves as the Company’s CEO then he/she is further limited to serving on only one other board of a publicly traded company while also serving on McCormick’s Board. All nominees are currently in compliance with these Board membership requirements, with the exception of Ms. Montiel and Messrs. Conway, Rodkin and Vernon withrequirements. With respect to the stock ownership requirement. Ms. Montiel and Mr. Conway joined the Board in 2015 and have until 2020 to meet the stock ownership requirement, while Messrs. Rodkin and Vernon, who joined the Board in 2017, and have until 2022.2022 to meet the requirement, and Ms. Bramman, who joined the Board in 2020, has until 2025. Compensation and Human Capital Committee Interlocks and Insider Participation No member of the Compensation and Human Capital Committee is, or during fiscal 20172020 was, an officer or an employee of McCormick or any of its subsidiaries, and no Committee member has any interlocking relationship with McCormick which is required to be reported under applicable rules and regulations of the SEC. For a discussion of insider participation in certain transactions, see “Procedure Regarding Transactions with a Related Person” above. McCORMICK & COMPANY, INCORPORATED - Proxy Statement 14

Compensation of Directors* The following table sets forth the compensation earned by the non-management directors for services rendered during the fiscal year ended November 30, 2017:2020: | Name | Fees Earned

or Paid in Cash

($)(1) | Stock

Awards

($)(2)(3) | Option

Awards

($)(2) | Total

($) | | Michael A. Conway | 90,000 | 100,014 | 60,015 | 250,029 | | J. Michael Fitzpatrick | 90,000 | 100,014 | 60,015 | 250,029 | | Freeman A. Hrabowski, III | 105,000 | 100,014 | 60,015 | 265,029 | | Patricia Little | 105,000 | 100,014 | 60,015 | 265,029 | | Michael D. Mangan | 120,000 | 100,014 | 60,015 | 280,029 | | Maritza G. Montiel | 90,000 | 100,014 | 60,015 | 250,029 | | Margaret M.V. Preston | 90,000 | 100,014 | 60,015 | 250,029 | | Gary M. Rodkin | 67,500 | 122,586 | 60,015 | 250,101 | | Jacques Tapiero | 90,000 | 100,014 | 60,015 | 250,029 | | W. Anthony Vernon | 45,000 | 115,082 | 60,017 | 220,099 |

| Name | | Fees Earned

or Paid in Cash

($)(1) | | | Stock

Awards

($)(2)(3) | | | Option

Awards

($)(2) | | | Total

($) | | Anne L. Bramman | | | 67,500 | | | | 122,621 | | | | 60,011 | | | | 250,132 | | Michael A. Conway | | | 90,000 | | | | 100,030 | | | | 60,011 | | | | 250,041 | | Freeman A. Hrabowski, III | | | 105,000 | | | | 100,030 | | | | 60,011 | | | | 265,041 | | Patricia Little | | | 91,667 | | | | 100,030 | | | | 60,011 | | | | 251,708 | | Michael D. Mangan | | | 115,000 | | | | 100,030 | | | | 60,011 | | | | 275,041 | | Maritza G. Montiel | | | 108,333 | | | | 100,030 | | | | 60,011 | | | | 268,374 | | Margaret M.V. Preston | | | 90,000 | | | | 100,030 | | | | 60,011 | | | | 250,041 | | Gary M. Rodkin | | | 90,000 | | | | 100,030 | | | | 60,011 | | | | 250,041 | | Jacques Tapiero | | | 90,000 | | | | 100,030 | | | | 60,011 | | | | 250,041 | | W. Anthony Vernon | | | 105,000 | | | | 100,030 | | | | 60,011 | | | | 265,041 |

| * | Lawrence E. Kurzius, Chairman, President & Chief Executive Officer, and Alan D. Wilson, Former Executive Chairman of the Board, are membersCEO, is a member of the Board of Directors and are or werewas also an executive officersofficer of the Company during fiscal 2017. Messrs.2020. Mr. Kurzius’ and Wilson’s compensation for fiscal 20172020 is set forth below under “Compensation of Executive Officers.” |

| (1) | Amounts shown include fees deferred at the election of the director, pursuant to the Company’s Non-Qualified Retirement Savings Plan, as follows: Dr. Hrabowski – $105,000; Ms. Little – $24,167; Ms. Preston – $90,000 and Mr. Tapiero – $90,000. |

| (2) | Amounts shown represent the aggregate grant date fair values computed in accordance with FASB ASC Topic 718 for each director. Awards include grants of RSUs (Stock Awards) and options (Option Awards) under the 2013 Omnibus Incentive Plan. For a discussion of the assumptions used in determining these values, see Note 1112 to our 20172020 financial statements.statements in our Annual Report on Form 10-K for the fiscal year ended November 30, 2020. |

| (3) | Amounts shown include RSUs granted in 20172020 and deferred at the election of the following director:directors: Dr. Hrabowski, Ms. Preston.Little, and Ms. Montiel. The amountsamount shown for Messrs. Rodkin and Vernon includeMs. Bramman includes the value of the Common Stock shares which was paid to themher as theirher first quarterly pro rated, Board retainer payment (see “Narrative to the Director Compensation Tables” below). |

McCORMICK & COMPANY, INCORPORATED - Proxy Statement 18 Options and RSUs The following chart sets forth the number of exercisable and unexercisable options (exercisable for Common Stock and Common Stock Non- Voting,Non-Voting, as indicated) and unvested RSUs held by each non-management director that served during fiscal 2017,2020, as of November 30, 2017:2020: | | | | Exercisable Options | | Unexercisable Options | | Unvested RSUs | | Name | Exercisable Options | | Unexercisable Options | | Unvested RSUs | | Common Stock | | Common Stock

Non-Voting | | | Common Stock | | Common Stock

Non-Voting | | | Common Stock | | Common Stock

Non-Voting | | | Common Stock | Common Stock

Non-Voting | | Common Stock | Common Stock

Non-Voting | | Common Stock | Common Stock

Non-Voting | | | Anne L. Bramman | | | | 0 | | | | 0 | | | | 4,524 | | | | 0 | | | | 1,468 | | | | 0 | | | Michael A. Conway | 10,000 | 0 | | 3,408 | 0 | | 1,039 | 0 | | 10,276 | | 0 | | 4,524 | | 0 | | 1,468 | | 0 | | | J. Michael Fitzpatrick | 30,000 | 0 | | 3,408 | 0 | | 1,039 | 0 | | | Freeman A. Hrabowski, III | 41,250 | 3,750 | | 3,408 | 0 | | 1,039 | 0 | | 77,092 | | 0 | | 4,524 | | 0 | | 1,468 | | 0 | | | Patricia Little | 30,000 | 1,250 | | 3,408 | 0 | | 1,039 | 0 | | 47,092 | | 0 | | 4,524 | | 0 | | 1,468 | | 0 | | | Michael D. Mangan | 37,500 | 2,500 | | 3,408 | 0 | | 1,039 | 0 | | 67,092 | | 0 | | 4,524 | | 0 | | 1,468 | | 0 | | | Maritza G. Montiel | 10,000 | 0 | | 3,408 | 0 | | 1,039 | 0 | | 30,092 | | 0 | | 4,524 | | 0 | | 1,468 | | 0 | | | Margaret M.V. Preston | 41,250 | 3,750 | | 3,408 | 0 | | 1,039 | 0 | | 50,912 | | 0 | | 4,524 | | 0 | | 1,468 | | 0 | | | Gary M. Rodkin | 0 | | 3,408 | 0 | | 1,039 | 0 | | 17,092 | | 0 | | 4,524 | | 0 | | 1,468 | | 0 | | | Jacques Tapiero | 22,500 | 0 | | 3,408 | 0 | | 1,039 | 0 | | 47,092 | | 0 | | 4,524 | | 0 | | 1,468 | | 0 | | | W. Anthony Vernon | 0 | | 3,260 | 0 | | 990 | 0 | | 16,796 | | 0 | | 4,524 | | 0 | | 1,468 | | 0 | |

Narrative to the Director Compensation Tables Directors who are employees of McCormick do not receive any fees for their service as a director. Mr. Kurzius was an employee of the Company during the whole of fiscal 2017 and Mr. Wilson was an employee of the Company through January 2017, at which time he began to receive fees for his service as a director.2020. The cash components of non-management director compensation are: (i) an annual retainer of $90,000, paid in equal quarterly installments (the first quarterly installment upon election to the Board is paid in Common Stock; subsequent quarterly payments are paid in cash), and (ii) for a director who serves as the Lead Director and/or as a Board Committee chair, an additional annual retainer of $25,000 and $15,000 in cash, (paidrespectively, provided that for the Audit Committee Chair the additional annual retainer is $20,000 (all paid in equal quarterly installments). Based on an assessment of compensation for non-management directors conducted in 2017, changes were approved, effective AprilEffective January 1, 2018, to increase2021, the additional annual retainersretainer for the AuditCompensation and Human Capital Committee Chair and the Lead Directorincreased from $15,000 to $20,000 and $25,000, respectively.(also all paid in equal quarterly installments). McCORMICK & COMPANY, INCORPORATED - Proxy Statement 15

In addition, non-management directors received an annual option grant in whole shares of common stockCommon Stock approximating the value of $60,000 under the 2013 Omnibus Incentive Plan. The shares subject to these options vest in full on March 15 of the year following the year in which the grant date occurs, provided that the director continues to serve on the Board until such date. Non-management directors also received an annual RSU grant in whole shares approximating the value of $100,000. The RSUs vest in full on March 15 of the year following the year in which the grant date occurs, provided that the director continues to serve on the Board until such date. All outstanding stock options become fully exercisable and all outstanding RSUs vest in the event of disability or death of the participant, or a change in control of McCormick, while the director is serving on the Board. Directors are eligible to participate in the McCormick Non-Qualified Retirement Savings Plan. Pursuant to this plan, directors may elect to defer anywhere from 10% to 100% of their cash Board fees. McCormick makes no contributions to the Directors’ Non-Qualified Retirement Savings Plan accounts. For all plan participants, including directors, the deferred amounts are recorded in a notional deferred compensation account and change in value based upon the gains and losses of benchmark fund alternatives (one of which tracks the performance of McCormick stock) selected by the participant. Plan participants may generally elect to change their fund choices at any time (there are certain restrictions applicable to participants subject to Section 16 of the Exchange Act). Director participants may elect the deferred amounts plus earnings to be distributed either six months following retirement from the Board or on an interim distribution date. Distributions upon a director’s retirement from the Board are paid in either a lump-sum or in 5 year, 10 year, 15 year or 20 year installments, based on the director’s distribution election. Interim distributions are paid on a lump-sum basis and the distribution date must be at least four years from the date of the deferral election. If a director leaves the Board prior to the interim distribution date, then his or her plan balance will be paid as either a lump sum distribution or as indicated in the retirement distribution election. Participants may make a change to their distribution election subject to the requirements of the plan and Section 409A of the Internal Revenue Code of 1986, as amended.Code. Amounts deferred under the Non-Qualified Retirement Savings Plan are held in a “rabbi” trust and remain subject to the claims of McCormick’s creditors until they are paid. Prior to the grant of RSUs, directors may elect to defer receipt of the underlying common stockCommon Stock upon vesting. If the director so elects, the director will not be considered the owner of the underlying common stockCommon Stock and will not receive voting rights or dividends on the stockCommon Stock until the deferral period expires, which is a date specified by the director or six months after the director’s departure from the Board. At the expiration of the deferral period, the director becomes the owner of the underlying common stock.Common Stock. McCORMICK & COMPANY, INCORPORATED - Proxy Statement 1619 | PROPOSAL 1 | ELECTION OF DIRECTORS |

Director Nominees The persons listed in the following table have been nominated by the Board for election as directors to serve until the next Annual Meeting of Stockholders or until their respective successors are duly elected and qualified. All nominees currently serve as directors. Management has no reason to believe that any of the nominees will be unavailable for election. In the event a nominee is unable to serve on the Board, or will not serve for good cause, the proxy holders will have discretionary authority for the election of any person to the office of such nominee. Alternatively, the Board may elect to reduce the size of the Board. W. Anthony Vernon joined the Board in May 2017 and is standing for election for the first time. Mr. Vernon was identified as a potential director by a third party search firm. The following table shows the names and ages of all nominees, the principal occupation and business experience of each nominee during the last five years, the year in which each nominee was first elected to the Board, and, as of the Record Date, the amount of McCormick common stock beneficially owned by each nominee, and the directors and executive officers of McCormick as a group, and the nature of such ownership. Except as shown in the table or footnotes, no nominee or executive officer beneficially owns more than 1% of either class of McCormick common stock. Required Vote of Stockholders The affirmative vote of a majority of all votes cast by holders of the shares of Common Stock present in person or by proxy at a meeting at which a quorum is present is required for the election of each nominee. For purposes of this proposal, a majority of the votes cast means that the number of shares voted “for” a director must exceed the number of shares voted “against” that director. The Board of Directors recommends that stockholders vote FOR each of the nominees listed below. Director Nominees

| | | | | Amount and Nature

of Beneficial Ownership(1) | | Name | | Principal Occupation & Business Experience | | Common | | Common

Non-Voting | | Michael A. Conway | | President, Licensed Stores, U.S. and Latin America (2016 to present); President, Global Channel Development, Starbucks Coffee Company (2013 to 2016); President, McNeil Nutritional, a division of Johnson & Johnson (2010 to 2013) | | 12,500 | | 0 | | Age 51 | | 10,000(2) | | 0(2) | | Year First Elected 2015 | | | | | | J. Michael Fitzpatrick | | Retired Executive (2012 to present); Chairman (2007 to 2012), Chief Executive Officer (2007 to 2010), Citadel Plastics Holdings, Inc. | | 73,863 | | 12,702 | | Age 71 | | 31,500(2) | | 500(2) | | Year First Elected 2001 | | | | | | Freeman A. Hrabowski, III | | President, University of Maryland, Baltimore County (1992 to present) | | 87,441 | | 10,099 | | Age 67 | | 56,325(2) | | 5,867(2) | | Year First Elected 1997 | | | | | | Lawrence E. Kurzius | | Chairman, President & Chief Executive Officer (2017 to present); President & Chief Executive Officer (2016 to 2017); Chief Operating Officer & President (2015 to 2016); President – Global Consumer (2013 to 2016); President – Global Consumer & Chief Administrative Officer (2013 to 2015); President – McCormick International (2008 to 2013); McCormick & Company, Incorporated | | 363,742 | | 0 | | Age 59 | | 291,236(2) | | 0(2) | | Year First Elected 2015 | | (3.5%) | | | | | | | | | | | Patricia Little | | Senior Vice President and Chief Financial Officer, The Hershey Company (2015 to present); Executive Vice President and Chief Financial Officer, Kelly Services, Inc. (2008 to 2015) | | 40,497 | | 1,946(3) | | Age 57 | | 30,000(2) | | 1,250(2) | | Year First Elected 2010 | | | | | | Michael D. Mangan | | Retired Executive (2010 to present); President, Worldwide Power Tools and Accessories, The Black & Decker Corporation (2008 to 2010); Senior Vice President, Chief Financial Officer, The Black & Decker Corporation (2000 to 2008) | | 52,575 | | 4,617 | | Age 61 | | 37,500(2) | | 2,500(2) | | Year First Elected 2007 | | | | | | Maritza G. Montiel | | Retired Executive (2014 to present); Deputy Chief Executive Officer & Vice Chairman (2011 to 2014) Managing Partner (2009 to 2011), Deloitte LLP | | 10,000 | | 2,500 | | Age 66 | | 10,000(2) | | 0(2) | | Year First Elected 2015 | | | | |

McCORMICK & COMPANY, INCORPORATED - Proxy Statement 1720 | | | | | | | | | | | | | Amount and Nature

of Beneficial Ownership(1) | | Name | | Principal Occupation & Business Experience | | Common | | Common

Non-Voting | | Margaret M.V. Preston | | Managing Director, Private Wealth Management, TD Bank (2014 to present); Managing Director US Trust, Bank of America Private Wealth Management (2008 to 2014) | | 73,829 | | 11,805 | | Age 60 | | | 43,484(2) | | 4,495(2) | | Year First Elected 2003 | | | | | | | Gary M. Rodkin | | Retired Executive (2015 to present); President and Chief Executive Officer, ConAgra Foods, Inc. (2005 to 2015) | | 240 | | 0 | | Age 65 | | | 0(2) | | 0(2) | | Year First Elected 2017 | | | | | | | Jacques Tapiero | | Retired Executive (2014 to present); Director, Esteve – Spain (2016 to present); Senior Advisor, McKinsey & Company LLC (2014 to present); Senior Vice President and President, Emerging Markets (2009 to 2014); President, Intercontinental Region (2004 to 2009); Eli Lilly and Company | | 29,164 | | 1,310 | | Age 59 | | | 23,844(2) | | 0(2) | | Year First Elected 2012 | | | | | | | W. Anthony Vernon | | Retired Executive (2015 to present); Senior Advisor and Executive Director (2014 to 2015) and Chief Executive Officer (2012 to 2014), Kraft Foods Group, Inc. | | 147 | | 0 | | Age 62 | | | 0(2) | | 0(2) | | Year First Elected 2017 | | | | | | | Directors and Executive Officers as a Group (18 persons) | | 2,477,427 | | 130,294 | | | | | | 2,005,738(2) | | 78,563(2) | | | | | | (20.6%) | | |

Director Nominees | | | | Amount and Nature

of Beneficial Ownership(1) | | Name | | Principal Occupation & Business Experience | | Common | | | Common

Non-Voting | | Anne L. Bramman | | Chief Financial Officer, Nordstrom, Inc. (2017 to present); Senior Vice President and Chief Financial Officer, Avery Dennison Corp. (2015 to 2017) | | | 264

0(2) | | | | 0

0(2) | | Michael A. Conway | | Executive Vice President & President, International Licensed Markets (2020 to present); Executive Vice President & President, Canada (2018 to 2020); President, Licensed Stores, U.S. and Latin America (2016 to 2018); President, Global Channel Development (2013 to 2016); Starbucks Corporation | | | 20,656

10,276(2) | | | | 0

0(2) | | Freeman A. Hrabowski, III | | President, University of Maryland, Baltimore County (1992 to present) | | | 191,588

110,544(2)

1.1% | | | | 7,405

4,234(2) | | Lawrence E. Kurzius | | Chairman, President & CEO (2017 to present); President & CEO (2016 to 2017); Chief Operating Officer & President (2015 to 2016); President – Global Consumer (2013 to 2016); McCormick & Company, Incorporated | | | 1,100,716

834,726(2)

5.8% | | | | 0

0(2) | | Patricia Little | | Retired Executive (2019 to present); Senior Vice President and Chief Financial Officer, The Hershey Company (2015 to 2019) | | | 66,918

48,470(2) | | | | 1,392(3)

0(2) | | Michael D. Mangan | | Retired Executive (2010 to present); President, Worldwide Power Tools and Accessories, The Black & Decker Corporation (2008 to 2010) | | | 102,622

67,092(2) | | | | 4,234

0(2) | | Maritza G. Montiel | | Retired Executive (2014 to present); Deputy Chief Executive Officer & Vice Chairman, Deloitte LLP (2011 to 2014) | | | 34,272

30,780(2) | | | | 5,000

0(2) | | Margaret M.V. Preston | | Retired Executive (2019 to present); Managing Director, Private Wealth Management, TD Bank (2014 to 2019) | | | 150,912

58,836(2) | | | | 14,849

1,490(2) | | Gary M. Rodkin | | Retired Executive (2015 to present); Chief Executive Officer, ConAgra Foods, Inc. (2005 to 2015) | | | 22,952

17,092(2) | | | | 0

0(2) | | Jacques Tapiero | | Retired Executive (2014 to present); Director, Esteve – Spain (2016 to present); Senior Advisor, McKinsey & Company LLC (2014 to present) | | | 67,770

47,092(2) | | | | 2,620

0(2) | | W. Anthony Vernon | | Retired Executive (2015 to present); Senior Advisor and Executive Director (2014 to 2015), Kraft Foods Group, Inc. | | | 22,372

16,796(2) | | | | 0

0(2) | | Directors and Executive Officers as a Group (17 persons) | | | 2,766,214

1,971,436(2)

13.9% | | | | 44,359

5,724(2) |

| (1) | Includes (i) shares of Common Stock and Common Stock Non-Voting beneficially owned by directors and executive officers alone or jointly with spouses, minor children, and relatives (if any) who have the same home as the director or executive officer; (ii) shares of Common Stock that are beneficially owned by virtue of participation in the McCormick 401(k) Retirement Plan: Mr. Kurzius – 6,972, Mr. Wilson – 10,801,14,152, executive officers as a group – 19,925;18,520; and (iii) shares of Common Stock which are beneficially owned by virtue of participation in the Non-Qualified Retirement Savings Plan: Dr. Fitzpatrick – 8,619; Dr. Hrabowski – 11,713;24,558; Mr. Kurzius – 13,907,29,158 Ms. Preston – 9,447;23,941; and Mr. Tapiero – 508 and Mr. Wilson – 1,117.1,753. |

| (2) | Number of shares included in the above number which can be acquired within 60 days of the Record Date pursuant to the exercise of stock options and/or the vesting of RSUs and/or shares earned under the LTPP. |

| (3) | Includes 201402 shares held for a family member in a separate household over which Ms. Little exercises voting and investment control. |

EXECUTIVE OFFICERS Named Executive Officers The following table shows as of the Record Date, the names, ages and positions of the executive officers named in the Summary Compensation Table (the “Named Executive Officers”), and, as of the Record Date, the amount of Common Stock and Common Stock Non-Voting beneficially owned by each such executive officer, and the nature of such ownership. Except as shown in the table, no executive officer owns more than 1% of either class of McCormick common stock. Mr. Kurzius is also included in the director nominee table. | | | | | | | | | | | | | Amount and Nature

of Beneficial Ownership(1) | | Name | | Principal Position | | Common | | Common

Non-Voting | | Lawrence E. Kurzius | | Chairman, President & Chief Executive Officer | | 363,742 | | 0 | | Age 59 | | | | 291,236(2) | | 0(2) | | | | | | (3.5%) | | | Michael R. Smith

Age 53 | | Executive Vice President & Chief Financial Officer (2016 to present); Senior Vice President, Corporate Finance (2015 to 2016); Senior Vice President, Finance Capital Markets & Chief Financial Officer North America (2014 to 2015); Chief Financial Officer & Vice President Finance EMEA (2012 to 2014); Vice President, Treasury & Investor Relations (2011 to 2012); McCormick & Company, Inc. | | 69,359 | | 7,924 | | | | 53,459(2) | | 4,575(2) | | | | | | | | | | | | | | | Brendan M. Foley

Age 52 | | President, Global Consumer and Americas (2017 to present); President, Global Consumer and North America (2016 to 2017); President, North America (2015 to 2016); President, U.S. Consumer Foods Division (2014 to 2015); McCormick & Company; President North American Zone (2013 to 2014); President U.S. Consumer Products (2012 to 2013); President, U.S. Food Service (2008 to 2012); H.J. Heinz Co. | | 51,604 | | 0 | | | | 49,824(2) | | 0(2) | | | | | | | | Jeffery D. Schwartz

Age 48 | | Vice President, General Counsel & Secretary (2014 to present); Associate General Counsel & Assistant Secretary (2011 to 2014); Associate Counsel & Assistant Secretary (2009 to 2011); McCormick & Company, Inc. | | 32,648 | | 203 | | | | 30,367(2) | | 0(2) | Malcolm Swift

Age 57 | | President, Global Industrial and McCormick International (2016 to present); President, Global Industrial (2015 to 2016); President – EMEA and Asia Pacific (2014 to present); President – EMEA (2008 to 2014); McCormick & Company, Inc. | | 115,566 | | 268 | | | | 105,024(2) | | 0(2) | Alan D. Wilson

Age 60 | | Retired Executive (2017 to present); Executive Chairman of the Board (2016 to 2017); Chairman (2009 to 2016); Chief Executive Officer (2008 to 2016); President (2007 to 2015); McCormick & Company, Incorporated | | 1,425,212(3) | | 75,567(3) | | | | 1,197,801(2) | | 58,600(2) | | | | | | (12.7%) | | |

| | | | Amount and Nature

of Beneficial Ownership(1) | | Name | | Principal Position | | | Common | | | Common

Non-Voting | Lawrence E. Kurzius

Age 62 | | Chairman, President & CEO | | | 1,100,716

834,726(2)

5.8% | | | | 0

0(2) | Michael R. Smith

Age 56 | | Executive Vice President & Chief Financial Officer (2016 to present); Senior Vice President, Corporate Finance (2015 to 2016); Senior Vice President, Finance Capital Markets & Chief Financial Officer North America (2014 to 2015); McCormick & Company, Inc. | | | 186,121

127,882(2)

1.0% | | | | 5,620

0(2) | Brendan M. Foley

Age 55 | | President, Global Consumer, Americas and Asia (2020 to present); President, Global Consumer and Americas (2017 to 2020); President, Global Consumer and North America (2016 to 2017); President, North America (2015 to 2016); McCormick & Company, Inc. | | | 254,227

208,016(2)

1.4% | | | | 539

0(2) | Jeffery D. Schwartz

Age 51 | | Vice President, General Counsel & Secretary (2014 to present); McCormick & Company, Inc. | | | 137,668

101,128(2) | | | | 406

0(2) | Malcolm Swift

Age 60 | | President, Global Flavor Solutions, EMEA and Chief Administrative Officer (2020 to present); President, Global Flavor Solutions and McCormick International (2018 to 2020); President, Global Industrial and McCormick International (2016 to 2018); President, Global Industrial (2015 to 2016); McCormick & Company, Inc. | | | 246,849

184,788(2)

1.4% | | | | 559

0(2) |

| (1) | Includes: (i) shares of Common Stock and Common Stock Non-Voting beneficially owned by the executive officers alone or jointly with spouses, minor children and relatives (if any) who have the same home as the executive officer; (ii) shares of Common Stock which are beneficially owned by virtue of participation in the McCormick 401(k) Retirement Plan: Mr. Kurzius – 6,972,14,152 and Mr. Smith – 2,152 and Mr. Wilson – 10,801;4,368; and (iii) shares of Common Stock which are beneficially owned by virtue of participation in the Non-Qualified Retirement Savings Plan: Mr. Kurzius – 13,90729,158 and Mr. WilsonFoley – 1,117.3,647. |

| (2) | Number of shares included in the above number which can be acquired within 60 days of the Record Date pursuant to the exercise of stock options and/or the vesting of RSUs and/or shares earned under the LTPP. |

| (3) | Includes 1,425,212 shares of Common Stock (1,197,801 shares of which can be acquired within 60 days of the Record Date) and 75,567 of Common Stock Non-Voting (58,600 shares of which can be acquired within 60 days of the Record Date) beneficially owned by Alan D. Wilson, as well as, 35,579 shares of Common Stock and 11,081 shares of Common Stock Non-Voting, respectively, held in a charitable trust for the Wilson Family Foundation, and 47,075 shares of Common Stock held in two separate grantor retained annuity trusts. Mr. Wilson serves as a trustee of each trust. Also includes 25,646 shares of Common Stock held in the Wilson Family Trust, as well as 5,818 shares of Common Stock and 34 shares of Common Stock Non-Voting, respectively, held in two separate trusts for the benefit of Mr. Wilson’s children, all shares of which Mr. Wilson may acquire voting or investment power within 60 days. |

COMPENSATION OF EXECUTIVE OFFICERS COMPENSATION DISCUSSION AND ANALYSIS Introduction The purpose of this Compensation Discussion and Analysis (CD&A)(“CD&A”) is to provide stockholders with a description of the material elements of McCormick’s compensation program for its executive officers, including the Named Executive Officers, for fiscal 20172020 and the policies and objectives which support the program. The compensation details are reflected in the compensation tables and accompanying narratives which follow. The CD&A is divided into the following sections: | • | ●Executive Summary | | • | Our Executive Compensation Philosophy and Practices |

| ● | Principles of McCormick’s Executive Compensation Policy |

| ●• | Overview of Our Executive Compensation Program for Fiscal 20172020 |

| ●• | How We Determined Executive Compensation for Fiscal 20172020 |

| ●• | Elements of Executive Compensation |

| ●• | Performance-Based Compensation and Risk |

Executive Summary 2020 was an unprecedented year, creating challenges for consumer goods companies, their employees and communities. In Fiscal 2020, our focus on growth, performance and people led to strong financial and operating performance, on both an absolute and relative basis. We learned from our experiences as the pandemic unfolded around the globe, and we adopted best practices throughout our business and operating units. We remained steadfast in our Power of People focus and communicated three key priorities: | • | First, ensuring the health and safety of all employees and the quality and integrity of our products; | | • | Second, maintaining business continuity; keeping our brands and our customers brands in supply as we continue to be essential to the world’s food supply; and, | | • | Third, ensuring that McCormick emerges stronger from this event. |

In all that they do, our employees demonstrate every day our committed focus on growth, performance, and people as we continue to drive strong long-term results which generated double-digit stockholder returns over the past 1-, 5-, 10- and 20-year periods. Importantly, in the last year we significantly exceeded the average return of both the broader market and the food industry. The outcomes under our variable pay programs reflect these achievements and demonstrate the stretch goals set for our Named Executive Officers. | • | Annual incentive awards in respect of fiscal 2020 ranged from 167% to 183% of target; and | | • | December 2018 Long-Term Performance Plan awards vested, in aggregate, at 173% of target. |

In fiscal 2020, the Compensation and Human Capital Committee continued to focus on ensuring ongoing alignment with our compensation philosophy, the design of our executive compensation programs, and the interests of our stockholders. CEO Compensation In November 2019, as part of our standard annual compensation process for all employees, including Named Executive Officers, and effective April 2020, the Compensation and Human Capital Committee approved adjustments to Mr. Kurzius’ 2020 compensation. These adjustments recognize his strong individual performance and the Company’s market-leading performance under his leadership, and to continue to improve the competitiveness of his total compensation relative to market. His annual base salary was maintained at $1.25 million, his bonus opportunity was maintained at 150% of base salary ($1.875 million), and his long-term incentive plan target was increased by 6.7% ($6.4 million), resulting in target total compensation of $9.525 million. The Committee is continuously focused on aligning pay with performance and the experience of our stockholders. As such, Mr. Kurzius received a one-time grant as part of the McCormick Value Creation Acceleration Program (“VCAP”) valued at $5.0 million. Further details on the VCAP are found throughout the balance of the CD&A. McCORMICK & COMPANY, INCORPORATED- Proxy Statement23 Other Named Executive Officer Compensation Also in November 2019, effective in April 2020, the Compensation and Human Capital Committee made adjustments to the compensation levels for the other Named Executive Officers. These adjustments equated to increases in target total compensation ranging from 3.4% to 14.6% for fiscal 2020 relative to fiscal 2019. In approving these adjustments, the Committee took into account individual and Company performance, as well as the general market competitiveness of compensation levels to deliver market-leading performance benefiting our stockholders, employees and customers. McCormick Value Creation Acceleration Program To motivate and reward the next phase of transformational performance and growth, the Compensation and Human Capital Committee, recommended, in consultation with its independent compensation consultant, and the independent members of the Board approved, a new long-term incentive grant program called the McCormick Value Creation Acceleration Program (“VCAP”). This program includes significant stock price performance objectives over the next five years that at maximum, would equate to a doubling of the Company’s market capitalization and create significant shareholder value. The participants of this program are a total of fifty-eight executive leaders, including the Named Executive Officers, who are in positions that lead and influence the Company’s next phases of performance and growth. Participants in the VCAP received a one-time stock option grant with three equally weighted stock price performance objectives triggered by stock price growth of 60%, 80%, and 100% over the next five years. These performance objectives must be achieved, and sustained, at an average price over thirty trading days at any time by the end of fiscal year 2025 for any tranche to vest. The awards are also subject to a three-year service period, meaning that if any of the three performance objectives are met during the first three years of the program, the options will not be exercisable until after the service period ends in fiscal year 2023. Any performance objectives that are not achieved by the end of the five-year performance period in 2025, will result in the cancellation of any relevant tranches of this award. The current Named Executive Officers will not receive any further awards under the VCAP for the duration of this five-year performance cycle. On conclusion of the five-year performance period, the Compensation and Human Capital Committee will assess the program’s success and continued relevance in the context of McCormick’s strategy at that time. The Compensation and Human Capital Committee, along with an independent compensation consultant, routinely conduct risk and compensation audits. As such, the Committee, as advised by its consultant, believes that there are sufficient safeguards against excessive risk taking and any one-time stock price anomalies considering the design of the VCAP program includes: the five-year performance period; the three-year service requirement; the significant stock price performance objectives that require maintaining an average price over a thirty-day trading period to meet any objective, the continuance of awards under the normal incentive programs that focus on operational excellence, and awards being covered by the existing clawback provisions under the 2013 Omnibus Plan. As noted above, other annual performance-based programs and long-term incentive programs will remain in effect and will continue to drive and reward underlying growth and performance. Further details on all of these items are provided in the balance of the CD&A. Our Executive Compensation Philosophy and Practices The core principlesphilosophy of McCormick’s executive compensation program continueis to be pay for performance while retainingand retain key talent. McCormick’s compensation program is designed to align McCormick’s executive compensation with our five guiding principles and long-term stockholder interests. Our executive compensation program includes elements with 1-, 3- and 10-year time horizons, along with a varied mix of payout factors tied to these elements to ensure that compensation is not focused on any one area above others, mitigating risk and ensuring a well-balanced recognition of both annual and long-term performance. McCormick’s compensation policy is based on the following compensation principles: | • | We must pay competitively – both as to the amount and type of compensation we offer in order to attract and retain our executive talent. | | • | A substantial portion of each executive’s total compensation should be performance-based and dependent on the achievement of financial and other performance goals over both the short and longer term. | | • | The financial performance goals should be drivers of stockholder value over the short and longer term, such as sales growth, and EPS. |

McCORMICK & COMPANY, INCORPORATED- Proxy Statement24 The framework of our executive compensation programs includes the governance features and other specific elements discussed below: | Compensation Practice | | Pursued at McCormick? | | Best Practice | | | Independent Compensation and Human Capital Committee and Consultant | | YES.McCormick’s Compensation and Human Capital Committee is comprised solely of independent directors. As well, the Committee’sThe Committee also engages an independent compensation consultant, Exequity L.L.P.Willis Towers Watson (WTW), to provide data, insight and advice. WTW (i) is retained directly by the Committee; (ii) performs little or no consulting or other services for McCormick; and (iii) is independent and there arewith no conflicts of interest with regard to the work of Exequity L.L.P.performed. | | ✔ | | | Compensation Risk Assessments | | YES.The Compensation and Human Capital Committee’s annual review and approval of McCormick’s compensation strategy includes a review of compensation-related risk management. In this regard, the Compensation and Human Capital Committee annually considers the relationship between the Company’s overall compensation policies and practices for employees, including executive officers, and risk, including whether such policies and practices (i) encourage imprudent risk taking, and/or (ii) would be reasonably likely to have a material adverse effect on the Company. The Committee believes that the Company’s compensation programs (executive and broad-based) provide multiple and effective safeguards to protect against undue risk. | | ✔ | | Favorable Risk Assessment for

Fiscal 20172020 | | YES.Exequity L.L.P., WTW, the Compensation and Human Capital Committee’s independent consultant, assessed the Company’s compensation policies and practices in fiscal 20172020 and concluded that they do not motivate imprudent risk taking. The Compensation and Human Capital Committee reviewed and agreed with this assessment. | | ✔ | | | Limited Perquisites and No Tax Gross-Ups | | YES.The NEO’sNamed Executive Officers receive a limited number of personal benefits and the Company does not provide tax gross-ups for personal benefits, makingmeaning these benefits are fully taxable to the recipient. | | ✔ | | | Employment Agreements | | NO.McCormick’s executive officers do not have employment agreements, except where legally required, and do not have guaranteed levels of compensation. | | ✔ | | | Pledging, Hedging or Speculative Trading | | NO.Executive officers are prohibited from pledging or hedging their Company stock (see discussion above under “Corporate Governance Guidelines”) and are prohibited from engaging in short sales or equivalent transactions in McCormick stock. | | ✔ | | | Stock Ownership | | YES.To further align the long-term interests of our executives and our stockholders, our Board has established stock ownership guidelines applicable to our CEO and executive officers. As well, a portion of an executive’s incentive award under the Long-Term Performance Plan (if earned) is paid in the form of stock. | | ✔ |

McCORMICK & COMPANY, INCORPORATED - Proxy Statement 20

Compensation Practice | | Pursued at McCormick? | | Best Practice | | Clawback Policy | | YES.McCormick’s 2013 Omnibus Incentive Plan (and the prior 2007 Omnibus Incentive Plan) outlines circumstances under which share-based and cash-based awards made under that plan may be forfeited, annulled, and/or reimbursed to McCormick, as described below. | | ✔ | | Focus on Performance- BasedPerformance-Based Compensation | | YES.The Compensation and Human Capital Committee endeavors to structure the executive compensation program so that each executive’s compensation is comprised of a majority of elements that are performance-based, including our annual incentive plan, Long-Term Performance PlanLTPP and stock options. We strive to maximize deductibility as “performance-based compensation” to the extent permitted under Section 162(m) of the Internal Revenue Code, which has been amended for future awards as described below.long-term equity incentive plan. | | ✔ | | Pay Well Aligned withand Performance Alignment Assessment | | YES.As part of Exequity L.L.P.’s annual analysis of Each year the pay for performance, it compares both a one-year and five-year review of McCormick’s CEO and performance of the Company is compared to CEO pay forand performance to McCormick’sat our peer companies. The performance measures include total stockholder return (TSR), change in stockholder value (SV) and earnings before interest and taxes (EBIT). For fiscal 2017,analysis conducted by the independent compensation consultant concluded that, while somein fiscal 2020 demonstrated strong alignment between pay elements for McCormick’s CEO were below the competitive range due to being recently promoted into the role, the total compensation design is aligned with performance and appropriately aligned with the market.performance. | | ✔ | | | Cap on Performance-Based Compensation | | YES.There is a cap for executive officer incentive payments made under the annual performance-based compensation and long-term incentive programs, and no payment is guaranteed under any incentive plans. | | ✔ | |

Principles of McCormick’s Executive Compensation Policy

McCormick’s compensation policy is based on the following principles:

| ● | We must pay competitively – both as to the amount and type of compensation we offer – as compared to the “Market Group” companies listed below in order to attract and retain our executive talent. |

| ● | A substantial portion of each executive’s total compensation should be performance-based and dependent on the achievement of financial and other performance goals over both the short and longer term. |

| ● | The financial performance goals should be drivers of stockholder value over the short and longer term, such as sales growth, earnings per share (EPS) and total stockholder return (TSR). |

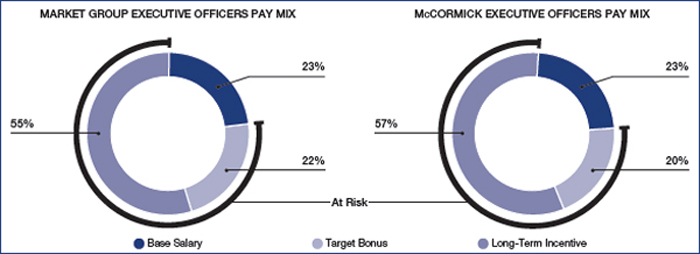

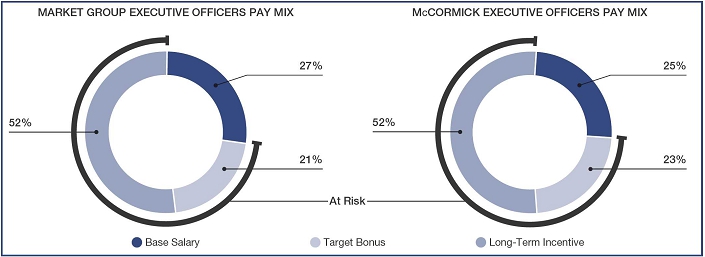

Overview of Our Executive Compensation Program for Fiscal 20172020 During fiscal 2017,2020, the primary elements of compensation earned by each of our Named Executive Officers consisted of base salary, an annual incentive cash payment, a long-term performance plan (in the form of cash-based and equity-based incentive awards), a long-term equity incentive program,plan (in the form of time-vested stock options and restricted stock), a limited number of personal benefits, and retirement benefits earned under our qualified retirement plans, our defined benefit pension plan, closed and frozen effective December 1, 2018 (Messrs. Kurzius, Smith, and Schwartz were the historic participants in the Company’s defined benefit plan), and supplemental executive retirement plan, which was frozen effective February 1, 2017 (Messrs. Kurzius Smith and WilsonSmith were the activehistoric participants in 2017 of the Company’s supplemental executive retirement plan). The Compensation Committee reviews and approves each element of compensation separately. If necessary, the Compensation Committee makes adjustments to individual elements of compensation to achieve the total targeted compensation that it believes is competitive with our Market Group and consistent with performance goals, all as explained below. In its deliberations, the Committee reviews “tally sheet” information for each executive officer, including the Named Executive Officers. The tally sheets are updated annually and include the elements of compensation noted above, the total estimated payments upon retirement, and the total estimated payments upon involuntary termination from McCormick.

The elements of the Executive Compensation Program described in the table below apply as stated to our US-based executive officers and it is our intent to follow our compensation principles and to provide similar benefits, where available and appropriate, to those executive officers located outside of the US. In 2017,2020, Malcolm Swift remained based in the UK and therefore subject to country-specific differences in benefits. McCORMICK & COMPANY, INCORPORATED- Proxy Statement 2125 OVERVIEW OF EXECUTIVE COMPENSATION PROGRAM FOR FISCAL 20172020 | | Element | | Objective | | Key Features | | Annual Cash Compensation | | Base Salary | | Provide a competitive annual fixed level of cash compensation. | | ●• Targeted at the 50th percentile of our Market Group.

● RepresentsOn average, represents about 25% of compensation mix for all Executive Officers as a group.

compensation. ●• Adjustments are based on individual performance, company performance, role scope, internal equity, and pay relative to theinformed by practices in our Market Group.

| | | Annual Performance- Based Incentive Compensation | | Motivate and reward executive contributions in producing annual financial results. | | ● Total cash compensation is targeted at the 50thpercentile of the Market Group.

●• Annual incentive cash payments are based on a formula that includes adjusted EPS growth, net sales and operating income growth, adjusted for working capital charges.

| | Long-Term Incentive Plan | | Long-Term Performance Plan | | Retain executives and align their compensation with the Company’s key financial goals to drive stockholder value over time. | | ●• Awards represent 50% of the overall annual long-term incentive mix.

• Awards based on the achievement of cumulative growth in net sales and relative TSR as compared to our Peer Group over the three-year performance period. ●• Annual grants of three-year overlapping cycles.

●• Earned awards to be delivered in cash and/or stock.(through cycle ending November 30, 2020) and PSUs.

| | | Long-Term Equity Incentive Program | Plan | Retain executive officers and align their interests with theour stockholders. | | ●• TotalAwards represent 50% of the overall annual long-term incentive compensation is targeted at the 50thpercentile of the Market Group’s total long-term incentive compensation.

mix. ●• Equity compensation isAwards made in the form of stock options which provide(25%) and RSUs (25%)

• Awards generally vest at a rate of one-third per year or, if earlier, upon the retirement eligibility date of the holder. | | Value Creation Acceleration Program | McCormick Value Creation Acceleration Program | Create significant value for stockholders with sustained shareholder return in the next five years and to thereward executive only to the extent that theleaders for transformational stock price appreciates.performance. | • One-time grant for the next five-years ●• Three-year service requirement

Stock options are non-qualified options that vest one third per year over• Five-year performance period

• Three equally weighted stock price growth performance objectives of 60%, 80%, and 100% • Ten-year stock option term • Unvested awards at the first three yearsend of the term of the option, which is no longer than 10 years. 2025 will be cancelled. | | Retirement Benefits | | Pension Plan (Defined Benefit) and

401(k) Retirement Plan | (Defined Contribution) | Provide retirement income for employees. | | ●• Tax qualified defined benefit pension plan (now closed(closed and to be frozen on December 1, 2018) in which many of our US employees, including some Named Executive Officers, are eligible to participate. Plan formula is based on age, years of service, and cash compensation.

●• The Company provides a match in the defined contribution 401(k) plan of up to 4%5% of eligible compensation.

| | | Supplemental Executive Retirement Plan (Defined Benefit) | (“SERP”) | Provide retirement income for eligible executives to replace a reasonable percentage of their annual pre-retirement income, and to facilitate an orderly transition within the ranks of senior management. | income. | ●• The plan was frozen on February 1, 2017.

●• For eligible executives who are age 50 and over, includes annual compensation over IRS limit and incentive bonus in the benefit calculation.

●• For certain executive officers, including eligible Named Executive Officers, includes one additional month of service credit for each month of service in the Plan between ages 55 and 60 up to a five year maximum.